How to Calculate Net Worth for Beginners

When I was in my early twenties, I thought I was “doing fine” financially. I had a steady paycheck, no trouble paying rent, and enough left over for weekend outings. Then one day, a friend casually asked me, “What’s your net worth?”

I froze. I had no idea.

Curiosity led me to sit down with a notebook and start listing what I owned versus what I owed. The result? My net worth was negative $12,500 thanks to student loans and a car loan. That was my wake-up call, I wasn’t as financially “healthy” as I thought.

This little exercise changed how I looked at money. It wasn’t about how much I earned every month. It was about whether my overall financial picture was moving forward or backward. That, in essence, is what calculating net worth does: it gives you a clear snapshot of your financial health.

Why Net Worth Matters More Than Income

Here’s a trap beginners fall into: thinking income equals wealth. It doesn’t.

Imagine two people:

-

Person A earns $120,000 a year but has a $600,000 mortgage, $50,000 in credit card debt, and two car loans.

-

Person B earns $55,000 a year but owns their home outright, has no debt, and a modest investment portfolio.

Who’s wealthier? Surprisingly, Person B.

That’s the beauty of net worth. It cuts through the noise of salary, lifestyle, or social media appearances and shows the raw truth: are you building wealth, or just treading water?

For beginners, calculating net worth is like stepping on a financial scale for the first time. It may be uncomfortable, but it’s necessary. Once you know the number, you can track it, improve it, and use it as a compass for your financial journey.

Step 1: List Your Assets (What You Own)

Think of assets as the “plus side” of your financial equation, everything you own that could be converted into cash if needed.

Common Types of Assets

-

Cash and Bank Accounts

-

Checking accounts, savings accounts, certificates of deposit.

-

This is your most liquid asset, money you can access quickly.

-

-

Investments

-

Stocks, bonds, mutual funds, ETFs, retirement accounts (401k, IRA).

-

For beginners, don’t stress over exact numbers. Pull balances from your statements.

-

-

Real Estate

-

Your home, land, or rental properties.

-

Use realistic market values, not what you wish your house is worth. Websites like Zillow can help.

-

-

Personal Property

-

Vehicles, jewelry, collectibles, valuable equipment.

-

Be conservative. A $30,000 car when new might only fetch $15,000 today.

-

💡 Beginner tip: Don’t waste time listing items like furniture, clothes, or old electronics. Unless they’re truly valuable, they don’t move the needle.

Step 2: List Your Liabilities (What You Owe)

Now comes the less fun part: your debts. These are the “minus side” of your financial equation.

Common Liabilities

-

Mortgage Loans: Your outstanding home loan balance.

-

Car Loans: What you still owe on your vehicle.

-

Student Loans: Federal or private education loans.

-

Credit Card Balances: Any unpaid revolving debt.

-

Personal Loans: From banks, online lenders, or even family.

Hidden liabilities often trip up beginners. Think of:

-

Taxes owed but not yet paid.

-

Buy-now-pay-later balances.

-

Small medical debts.

🎯 The goal isn’t to feel bad about debt. It’s to face it clearly so you can start reducing it.

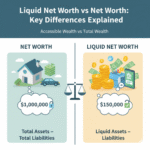

Step 3: Do the Math

Here’s the simple formula:

Net Worth = Total Assets – Total Liabilities

Example 1:

-

Assets: $150,000 (house, savings, retirement, car).

-

Liabilities: $100,000 (mortgage, student loans, credit cards).

Net Worth = $150,000 – $100,000 = $50,000

Example 2 (Negative Net Worth):

-

Assets: $20,000 (car, savings).

-

Liabilities: $35,000 (student loan, credit cards).

Net Worth = $20,000 – $35,000 = -$15,000

Negative net worth isn’t uncommon, especially if you’re just starting out. The point isn’t to obsess over the number today. It’s to create awareness and a roadmap for growth.

Step 4: Track Net Worth Over Time

One-time calculation = a snapshot. Tracking over time = a movie.

How to Track

-

Spreadsheets: Simple and free. Log your assets and debts quarterly.

-

Apps: Tools like Mint, YNAB, or Personal Capital automate the process.

-

Pen & Paper: Even old school works, as long as you’re consistent.

The key is comparing progress:

-

Did your savings grow?

-

Did your debt shrink?

-

Is your investment portfolio compounding?

💡 Pro tip: Track net worth quarterly, not daily. Too-frequent checks lead to stress, especially when markets dip.

Case Studies: Real-Life Net Worth Snapshots

1. Sarah, 28, Teacher

-

Assets: $20,000 savings, $10,000 retirement, $5,000 car = $35,000

-

Liabilities: $25,000 student loan, $3,000 credit card = $28,000

-

Net Worth: $7,000

Sarah’s focus? Pay down her student loans while continuing to invest for retirement.

2. James, 35, IT Professional

-

Assets: $60,000 in 401k, $25,000 home equity, $10,000 cash = $95,000

-

Liabilities: $40,000 mortgage, $15,000 car loan = $55,000

-

Net Worth: $40,000

James is growing wealth steadily but could accelerate by paying off the car loan early.

3. Maria, 50, Small Business Owner

-

Assets: $300,000 home, $200,000 business value, $100,000 investments = $600,000

-

Liabilities: $150,000 mortgage, $50,000 business loan = $200,000

-

Net Worth: $400,000

Maria is in a strong position but must protect her business assets with proper insurance.

Common Mistakes Beginners Make

-

Overestimating Assets: Using the car’s purchase price instead of resale value.

-

Ignoring Liabilities: Forgetting “small” debts like unpaid taxes.

-

Confusing Income with Wealth: A big paycheck means little if debt eats it up.

-

Not Updating Regularly: Net worth is a living number, not a one-time event.

Practical Tips to Improve Net Worth

-

Pay Down High-Interest Debt First: Credit cards and personal loans drag your net worth down the fastest.

-

Automate Savings: Set up direct transfers into savings or investment accounts.

-

Invest Early and Consistently: Even $200 a month compounds massively over decades.

-

Boost Assets with Side Income: Freelancing, online businesses, or real estate rentals.

-

Review Annually: Treat it like a financial checkup.

FAQs

What if my net worth is negative?

That’s okay. Many beginners start there due to student loans. The key is making progress toward positive.

Should I include my car as an asset?

Yes, but only at resale value. Cars depreciate fast.

Do personal belongings count?

Not unless they’re valuable (antiques, art). Everyday items aren’t worth tracking.

How often should I calculate net worth?

Quarterly works well. Too often = stress, too rarely = lack of awareness.

Can net worth replace budgeting?

No. Budgeting manages cash flow; net worth tracks wealth. You need both.

Should I include retirement accounts?

Absolutely. They’re long-term assets and part of your wealth.

Do I include my business?

Yes, if you own one. Use conservative valuations.

What about mortgages?

Include both the home value (asset) and outstanding mortgage (liability).

Conclusion: Your Financial Compass

Learning how to calculate net worth for beginners is like taking your first real look in the financial mirror. It may surprise you, encourage you, or even scare you, but it will always tell you the truth.

The beauty of net worth is that it’s not fixed. With steady savings, debt reduction, and smart investing, your number will grow. More importantly, tracking it regularly keeps you mindful of where you are and where you’re going.

Remember: income pays the bills, but net worth builds freedom. Start today, calculate honestly, and let that number guide you toward a stronger financial future.