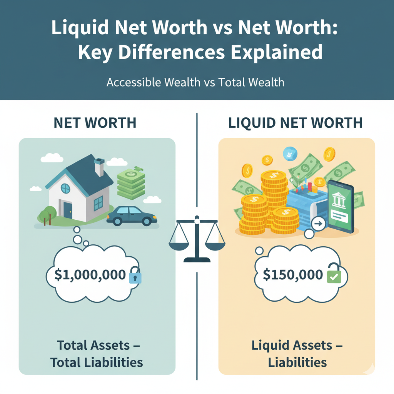

Liquid Net Worth vs Net Worth: Key Differences Explained

Ever wondered why two people with the same net worth can have completely different levels of financial security? Imagine this: Person A has a net worth of $1 million, but most of it is tied up in real estate and retirement accounts. Person B has a net worth of $500,000, but half of it is in cash and investments they can access today. Who’s in the stronger financial position?

That’s where the liquid net worth vs net worth difference comes in. Understanding this gap isn’t just financial jargon, it’s the key to knowing whether your wealth can actually support your day-to-day life and protect you in emergencies.

What is Net Worth?

At its core, net worth is the simplest way to measure your financial standing.

Formula:

Net Worth = Total Assets – Total Liabilities

-

Assets include everything you own: real estate, cars, investments, retirement accounts, and cash.

-

Liabilities are what you owe: mortgages, loans, credit card balances, etc.

Example:

If you own a $400,000 home, have $100,000 in investments, $50,000 in savings, but owe $300,000 on your mortgage and $20,000 on loans, your net worth is:

(400,000 + 100,000 + 50,000) – (300,000 + 20,000) = $230,000

Net worth is a great snapshot of overall financial health—but it doesn’t tell the whole story.

What is Liquid Net Worth?

Here’s where liquidity steps in. Liquid net worth focuses on the assets you can quickly convert to cash without losing much value.

Liquid Net Worth = (Cash + Easily Sellable Assets) – Liabilities

What counts as liquid assets?

-

Cash in bank accounts

-

Stocks, bonds, mutual funds

-

Certificates of deposit (CDs) that can be withdrawn with little penalty

-

Money market accounts

What doesn’t count as liquid?

-

Real estate (can take months to sell)

-

Retirement accounts with heavy penalties for early withdrawal

-

Cars and collectibles (value can fluctuate and buyers aren’t guaranteed)

In short, liquid net worth meaning is: how much of your wealth is available when you need it most.

Key Differences: Net Worth vs Liquid Net Worth

| Feature | Net Worth | Liquid Net Worth |

|---|---|---|

| Assets Included | All assets (liquid + non-liquid) | Only assets quickly convertible to cash |

| Accessibility | May include wealth you can’t touch easily | Reflects what you can use immediately |

| Use Case | Long-term financial health | Short-term financial security & flexibility |

| Example | House value, retirement funds, investments | Cash, stocks, money market funds |

The personal net worth vs liquid net worth debate is less about which is “better” and more about what question you’re trying to answer.

-

Net worth tells you how wealthy you are overall.

-

Liquid net worth tells you how financially flexible and secure you are right now.

Real-World Examples

Example 1 – High Net Worth, Low Liquidity:

John owns $1M in real estate and has $50K in retirement accounts. But he has only $5K in his checking account. While his net worth looks impressive, his liquid net worth is just $5K. If an emergency hits, he may struggle.

Example 2 – Lower Net Worth, High Liquidity:

Sarah has a $300K net worth, but $150K is in cash and stocks she can access quickly. Her liquid net worth is strong, giving her financial peace of mind even if her net worth is lower than John’s.

This shows why why liquid net worth matters, it’s about having usable wealth, not just theoretical value.

Why Liquid Net Worth is More Practical

While both metrics are useful, liquid net worth often paints a clearer picture of financial stability.

-

Emergency readiness: If you lose your job tomorrow, liquid assets cover your expenses.

-

Opportunity leverage: Having liquid funds lets you invest in opportunities without selling illiquid assets at a loss.

-

Peace of mind: Knowing you can access your money reduces stress, even if your net worth isn’t sky-high.

Simply put: net worth shows potential wealth; liquid net worth shows usable wealth.

How to Calculate Both

Step 1: List Your Assets

-

Cash, savings, stocks, real estate, cars, retirement accounts.

Step 2: Subtract Liabilities

-

Mortgages, loans, credit card balances.

That’s your net worth.

Step 3: Separate Liquid from Non-Liquid Assets

-

Add up only cash + easily sellable investments.

-

Subtract liabilities again.

That’s your liquid net worth.

Tip: Use a simple spreadsheet or financial app to update this monthly.

Mistakes People Make

-

Confusing wealth with liquidity: A millionaire who can’t pay their bills isn’t financially secure.

-

Ignoring debt: Having $200K in assets but $180K in debt inflates net worth but hurts liquidity.

-

Overvaluing illiquid assets: Homes and cars don’t equal emergency funds.

-

Not balancing both metrics: Focusing only on net worth hides short-term risks.

FAQs

Does real estate count as liquid net worth?

No, real estate is generally non-liquid since selling takes time and may involve losses.

Are retirement accounts liquid assets?

Not usually—early withdrawals often carry taxes and penalties.

What’s a good liquid net worth ratio?

Financial planners often suggest keeping at least 3–6 months of living expenses in liquid assets.

Conclusion

Understanding the liquid net worth vs net worth difference is like knowing the difference between being rich on paper and being financially ready in real life.

You don’t just want to look wealthy, you want the flexibility to cover emergencies, seize opportunities, and sleep at night knowing your money is accessible.

Take a moment today to calculate both your net worth and liquid net worth. You might be surprised by the difference, and that awareness could be the first step toward true financial freedom.